Non-Fungible Tokens or NFTs. We all know what they are, especially if you've been into decentralized technology even for a minimum of three months.

Yes, they are those high rendition JPEGs you see every now and then selling for some kind of cryptocurrency on marketplaces, X formerly known as Twitter, discord or whatever platform you use in communicating with other decentralized enthusiasts, or should I say "degens".

The Rise of Non-Fungible Tokens almost seemed like it was going to shake the Blockchain atmosphere and unravel the next best thing, but then something happened.

Something that a select few saw coming, but every other person was oblivious to. What happened?

The Origin of Non-Fungible Tokens

To understand what went wrong with NFTs let's take a moment to briefly go through its history.

The first-ever type of Non-Fungible Tokens came into existence in 2014. During this time, the world of decentralization was still pretty much dormant and almost no one had any real use for it until the Ethereum blockchain network had gained massive user adoption across the globe.

Ethereum served as a precursor for the adoption and use cases of these Non-Fungible Tokens, like a gold mine, where real-world problem-solving innovations scale with a community of millions of users.

It has spearheaded most of the creation of the blockchain applications we know and make use of today, from smart contracts to Initial Coin Offerings (ICO), as well as things like Decentralized Finance (DeFi), and in 2017 came the rise of NFTs.

What Exactly is an NFT?

Well, for anyone curious, an NFT is a kind of digital certificate of authenticity that assigns ownership of a unique item or asset.

Note: The word item here isn't limited to objects that can be touched. Anything can be an item, a post on X, and even this article can be an NFT.

It isn't if you were wondering, so yeah, you can't sell this and cash out.

The easier way to think of an NFT is to think of it as a receipt for a purchase of an item on the blockchain, and whoever holds this receipt is the designated owner of the NFT as long as the blockchain is active to keep a record of it.

The NFT Revolution

The NFT Revolution was a period of the peak of Non-Fungible Tokens in 2021-2022 that coincided with the last bull run spanning from 2020 to late 2021.

Cryptocurrency prices were ridiculously high and Bitcoin had hit an all-time high (ATH) of $65K, turning more and more people into crypto enthusiasts and driving users to the blockchain atmosphere.

During this period, the NFT markets were booming and blossoming alongside the market, to the point it evolved into its own ecosystem of enthusiasts known as the degens.

The NFTs created sold for hundreds, hundreds of thousands, and even millions of dollars, especially on robust marketplaces such as Opensea, which boasted a total of 1.5 million active users with 115 million plus visitors.

A research pulled from Dune Analytics --an open-source data provider of real-time crypto trends.

From the statistics above anyone can see that NFTs transcended mere casual conversation in the world of finance and business, they marked the beginning of what would seem like a revolution while yielding substantial profits per sale.

A month back on August 4, 2023, Opensea published an article here, detailing the 'top 10' most expensive NFTs sold, and a rough approximation of the total figure (excluding Merge, the honorary mention) equals 230 million dollars.

More than a quarter of a billion dollars was generated in such a short duration for just 10 kinds of NFTs.

So, What Went Wrong?

Let's get into the details. Rolling Stone recently published an article titled "Your NFTs Are Actually — Finally — Totally Worthless" Yes, they did that.

This most definitely struck a nerve in the heart of every NFT enthusiast such as myself, and every one of us who knows the true purpose of these Non-Fungible Tokens.

The internet is a hub for authors and bloggers who publish content that could potentially damage the credibility of anyone and anything, and from the amount of traffic Rolling Stone attracted from their headline alone, it's clear that the damage was done.

But, the article does hold some water and if anyone puts the facts together they'll easily arrive at the same conclusion as the headline.

Let's Analyse it!

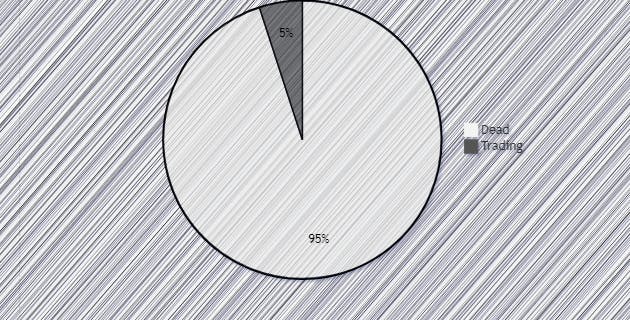

A study by dappGambl found that 69,795 out of a selected sample of 73,257 NFT collections have a market cap of zero (0). 69,795 out of 73,257 represents 95 percent (%) of the total figure.

The stats further went on to reveal that 23 million people are in ownership of these assets that currently have no significant value. Because of this, it is understandable that the market can be proclaimed 'dead' as it took such a massive fall from grace right before our eyes.

But what the nay-saying blogs and publications forget to mention is that most of these projects were a bunch of Ponzi schemes and destined-to-rug projects with little to no actual use case or compelling motives and no rare artistic features to even make it worth buying for the sake of art.

This is what went wrong.

As a community instead of advocating for the end of these schemes, a large number of people encouraged it but these were people who were only into NFTs for the benefit of it.

The existence of so many refined ponzi and pyramid schemes, in partnership with the start of the crumbling bear market unanimously collaborated to drag the floor prices of these tokens to the floor and NFTs with no use case eventually lost users that had fallen for their ponzis and finally realized it.

You could go back to any of those discord channels where degens shilled new NFTs to each other and find them empty. Servers that once used to buzz with non-stop messages.

So, Dead or Alive?

Trivia technicalities aside, NFTs are far from dead. Statistics show that a total of $63 million was traded last week, granted this is a fall from the $360 million weekly volume observed in February, but it is safe to say that what indeed had died was the hype and never the technology, another omission from mainstream publications and their authors looking for clicks and traffic.

This is normal, as trends rise and fall, we can recall a time when everyone went crazy for Open AI's LLM ChatGPT.

Enthusiasts have embraced this change, as it has helped solve one of the biggest problems; eliminating the ponzis that had saturated the market, creating a low demand high supply environment that was intoxicating.

Think of it as a purge that had long been overdue, and with this welcomed change people will start to see the true purpose of NFTs, besides being pretty and shiny JPEGs to be bought and sold in a desperate attempt to make money.

Conclusion

Non-Fungible Tokens were, and still are considered a revolutionary technology that would change the way we perceive and handle ownership of assets tied to blockchain technology.

Smart contracts create these NFTs and serve as the basic laws that govern the handling of the tokens, so as long as blockchain technology stays relevant, NFTs will always be just as relevant, and to think otherwise is ludicrous.

You've come to the end of the article. If you have any questions, leave a comment. If you want more simplified articles like these, follow me for more Blockchain and Web3-related articles.

Click on this link to get in touch with me on my socials. See you next time.